The Hidden Costs of Title Insurance

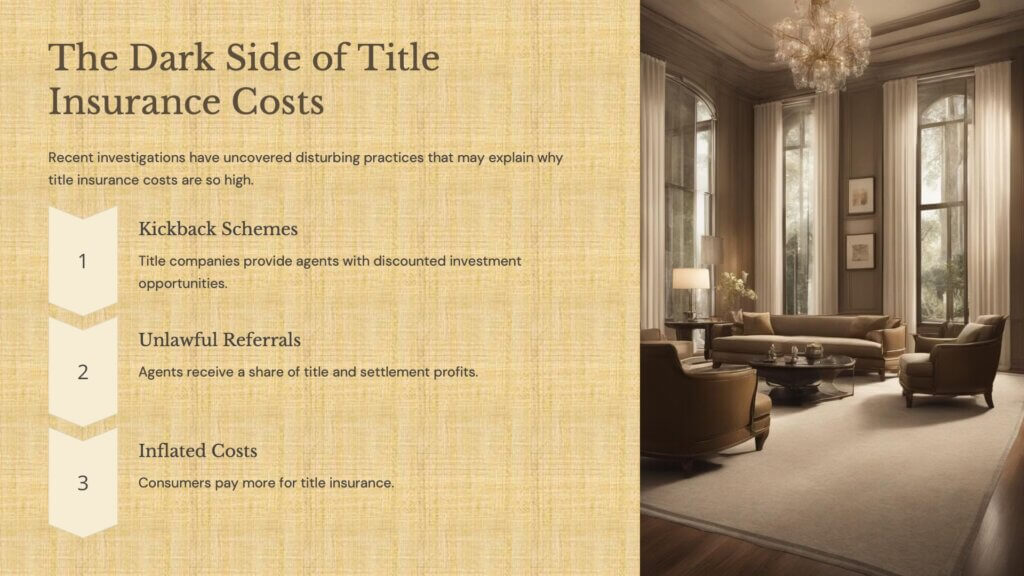

Recent investigations, like the one in Washington D.C., have uncovered disturbing practices that may explain why title insurance costs are so high. Four title companies were found to have engaged in illegal kickback schemes with real estate agents. These companies unlawfully provided agents with discounted investment opportunities, offering them a share of the title and settlement profits in exchange for client referrals.

In One particularly egregious example the company offered ownership interests in the partnership without requiring agents to invest any money upfront. And another company was rewarding agents with lavish experiences, including yacht outings, in exchange for steering clients their way. These kickback schemes not only inflate the cost of title insurance but also limit consumers’ choices, making the home buying process more expensive and less transparent.

Leave a comment

Sign in to post your comment or sign-up if you don't have any account.