We all know about the tragedy in Surfside, where a 13-story building collapsed on Thursday, June 24, 2021. More than 2 months have passed since the event, and in this issue we will take a look at real estate market to understand how the Surfside crash affected the local real estate conditions.

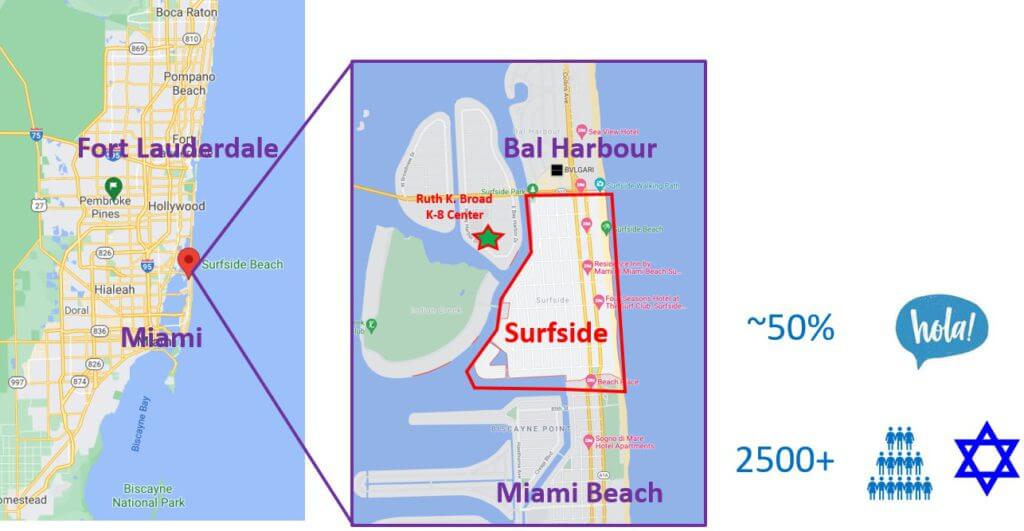

Surfside is an ocean-front town in Miami-Dade County, South Florida. The city is located just north of Miami Beach and south of Bal Harbor. The city has a total area of only 1 square mile (2.5 square kilometers) and has a population of about 5,600 people. Half of the city’s residents speak Spanish. Surfside is also Miami’s most Jewish community.

This city belongs to the Miami Dade County Public Schools Districts. Ruth K. Broad / Bay Harbor K-8 Center Public Elementary School is located on the Bay Harbor Islands. It is a very good school with a 10 out of 10 rating according to Great Schools. The middle school is called Miami Beach Middle Nautilus and the high school is Miami Beach Senior High.

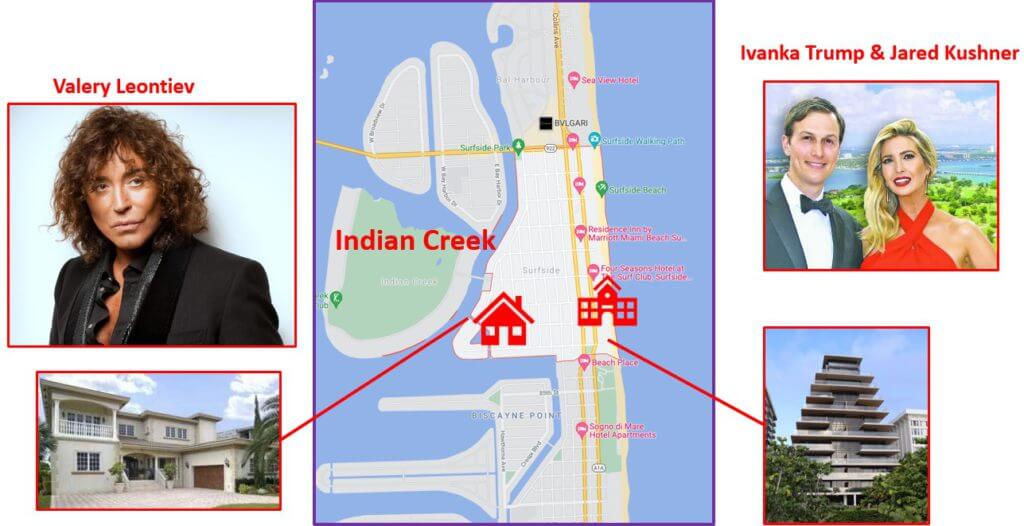

Notable people who live in Surfside are Ivanka Trump and Jared Kushner. They are currently renting an apartment in the newly built Arte Building. They plan to move to the neighboring Indian Creek Island once they finish building their new home there. You can also find other celebrities at Surfside – for example, Russian singer Valery Leontiev lives in a private house in the western part of the city.

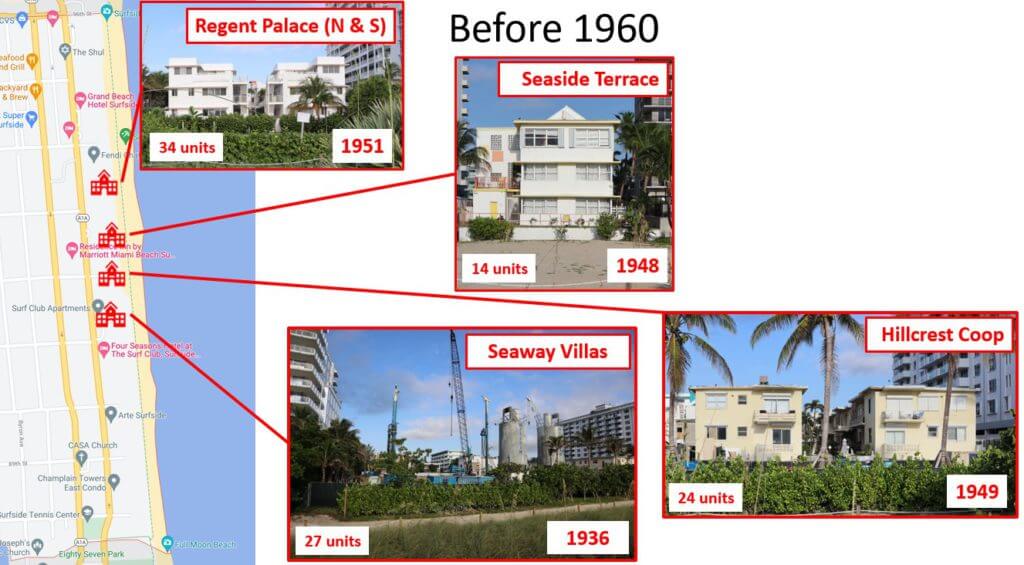

Now let’s take a look at Surfside real estate. Surfside has a total of 26 oceanfront residential buildings. There are almost 2,000 apartments in these buildings. The oldest of them is Seaway Villas Condos – it was built in 1936 and was recently demolished to make way for an expansion of the neighboring Surf Club Fours Seasons complex.

Three buildings were built before 1960: Seaside Terrace (built 1948), Hillcrest Coop (built 1949) and Regent Place (built 1951). All of them are really very small structures by modern standards. Seaway Villas had 27, Seaside Terrance had 14, Hillcrest Coop had 24, and Regent Place had 34 apartment units.

There have been no buying or selling activities in these buildings in the last 12 months. This is most likely due to old age, as there are already plans to replace these buildings with newer ones, as happened with Seaway Villas Condo.

The first boom in real estate construction began in the 60s of the 20th century. Over the next 20 years, 5 new buildings were built at Surfside. All of them were at least 11 floors and each had more than 100 apartments. All of these buildings were built prior to the construction of the Champlain South building. Carlisle was built in 1965, Spaiggia was built in 1965, Four Winds in 1967, 9500 Ocean in 1970, and the Manatee building was built in 1974. Recent transaction amounts in these buildings range from $ 300,000 to $ 600,000, depending on the size and format of the building itself. Typical dwellings are 900-1100 square feet 2-3-room apartments. (83-102 sq.m)

In 1980, only 3 buildings were built, including the collapsed Champlain South building. Champlain North was built at the same time as Champlain South by the same developer. For this reason, the north tower of Champlain is undergoing a thorough investigation at the moment to find out if there are any structural problems. And the third tower of the 80s is the Marbella building, built in 1989.

Before the collapse of the south tower of Champlain, 3-4-room apartments were selling for between $ 500k and $ 1 million. The last sale in Champlain South was a 1,748 square foot (162 sq ft) three-room apartment for $ 710,000, just a week before the disaster. There is currently a $ 725,000 one-bedroom apartment in the North Tower of Champlain for sale and a four-room apartment in the Marbella building for $ 1.25 million.

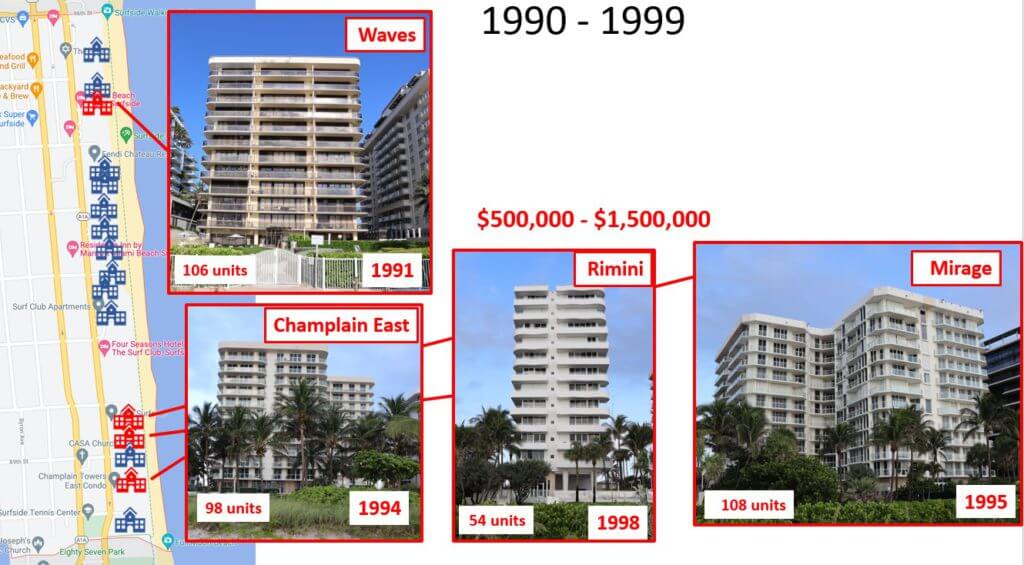

In 1990, 4 buildings were built, including the last building in Champlain East – the east tower with 98 apartments. Other towers are the 106-unit Waves built in 1991, the 108-unit Mirage built in 1995, and the smaller 54-unit building in Rimini built in 1998.

With the exception of the Waves Condominium, these buildings were built after Hurricane Andrew. 3-4-room apartments have recently been sold at prices ranging from $ 500,000 to $ 1,500,000. There are currently 11 apartments on display at prices ranging from $ 536,000 for the condominium in the Rimini building and up to $ 1,750,000 for the condominium in the Mirage building.

Three buildings were built between 2000 and 2010: two Solimar twin towers with 118 apartments in each building in 2001, the Waverly building with 64 apartments in 2003 and the Azure building with 81 apartments in 2005. They started the trend of building luxury buildings with fewer apartments. Apartments in the Solimar Towers recently sold for between $ 550,000 and $ 1 million for three-bedroom apartments ranging from 1,260 to 1,740 sq. ft (117-162 sqm).

There are currently 10 apartments for sale at an average price of $ 1.3 million. The median asking price for a condominium in Waverly is $ 1,150,000. The most coveted building of these three is Azure. There are currently only 2 apartments on the market with an average price of $ 2,075,000, and recent sales have ranged from $ 875,000 to $ 2.35 million.

Over the past 10 years, 5 new buildings have been built. The trend towards the construction of luxury homes continued: apartments in buildings became larger and more expensive. Ocean 7 has only 7 townhouses and this building was completed in 2014. There are currently two five-bedroom residences on sale for about $ 4 million. Fendi Chateau was built in 2016 and has 57 apartments. The last sales of each of them exceeded $ 5 million. There is currently only 1 apartment for sale with an offer price of $ 13.6 million.

The Surf club Four-Seasons complex has two separate buildings with 129 apartments, completed in 2017. There are currently 5 apartments on the markets with an average asking price of about $ 15 million. The average residence size is 3,732 square feet (347sqm). And the last building – Arte was built in 2020. It has a total of 16 residences. This year there were 7 sales with prices ranging from 9 to 22.5 million.

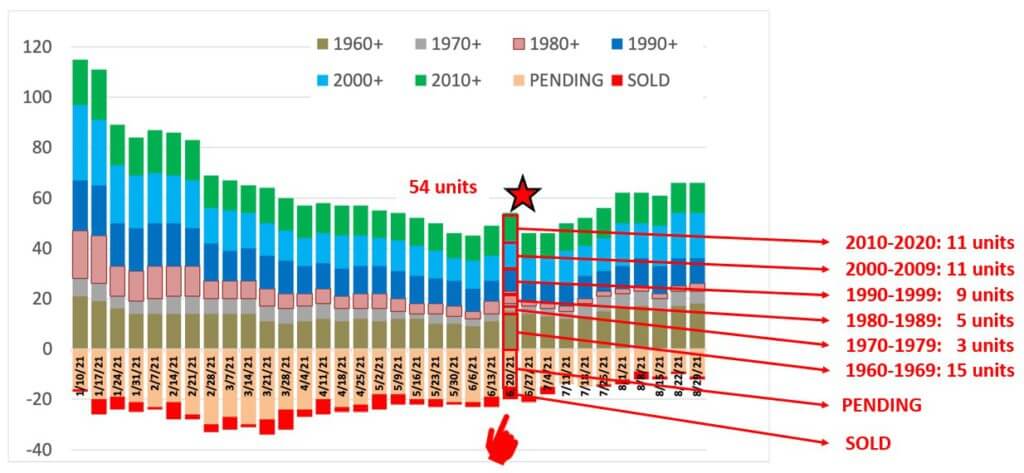

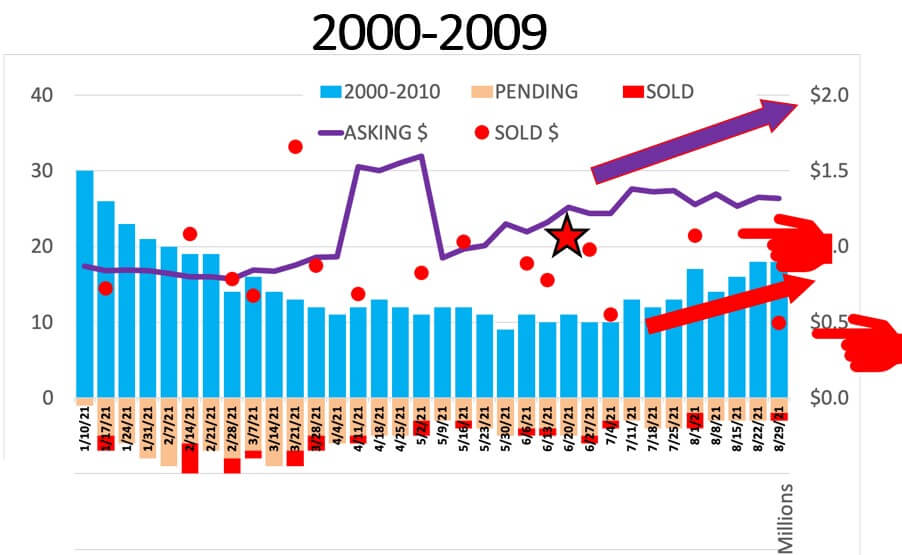

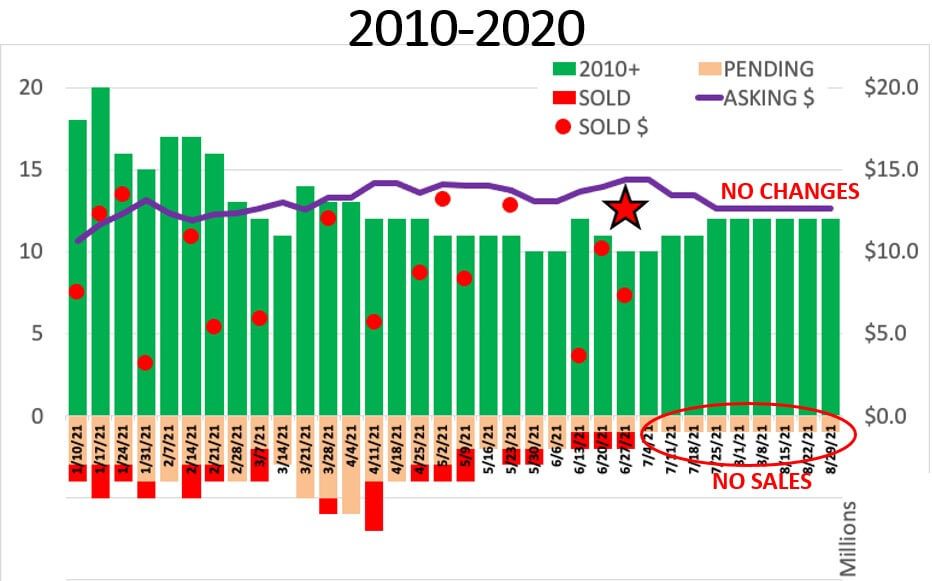

Now let’s take a look at what happened to the Surfside Oceanfront Inventory after the tragic incident in Champlain South two months ago. The following chart shows the weekly inventory levels starting in January 2021. Each bar shows the inventory level by year.

As an example, consider the column corresponding to the week before the building collapses. As of June 20, 2021, there were 54 residences for sale on the market. 11 properties are represented in buildings built after 2010, 11 in buildings built between 2000 and 2010, 9 in the 90s, 5 in the 80s, including a couple of apartments in towers Champlain, 3 – in a building built in the 70s and 15 in buildings built before 1970. 10 were pending and 2 trades were closed this week.

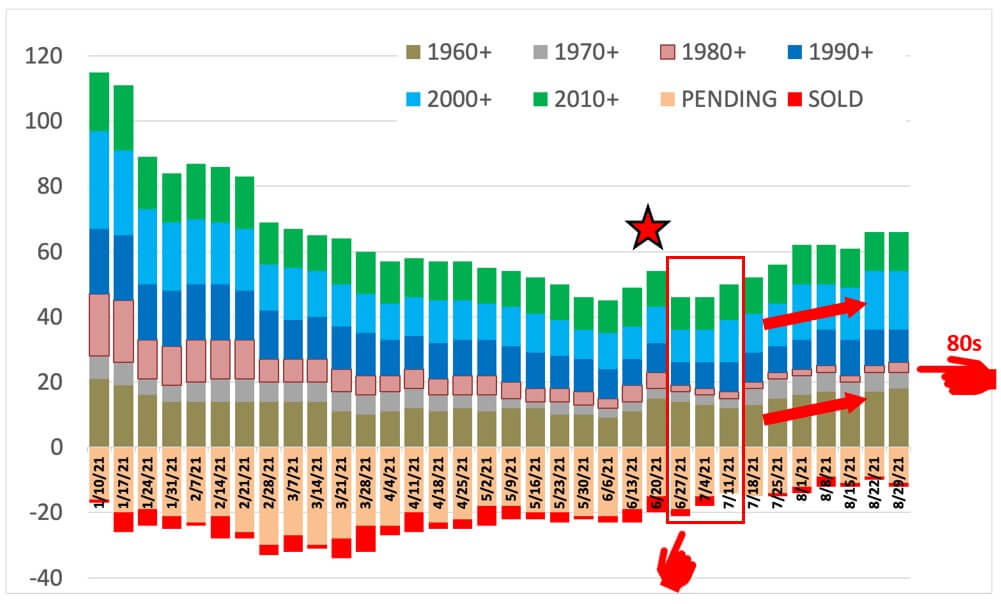

In the first 3 weeks after the collapse, there were no significant changes in inventory levels. Several apartments have been removed from the market in old buildings. During this period, 5 transactions were even concluded. However, in July we see that new apartments entered the market, both in the old and in the new segment. The only inactive segment is houses built in the 80s.

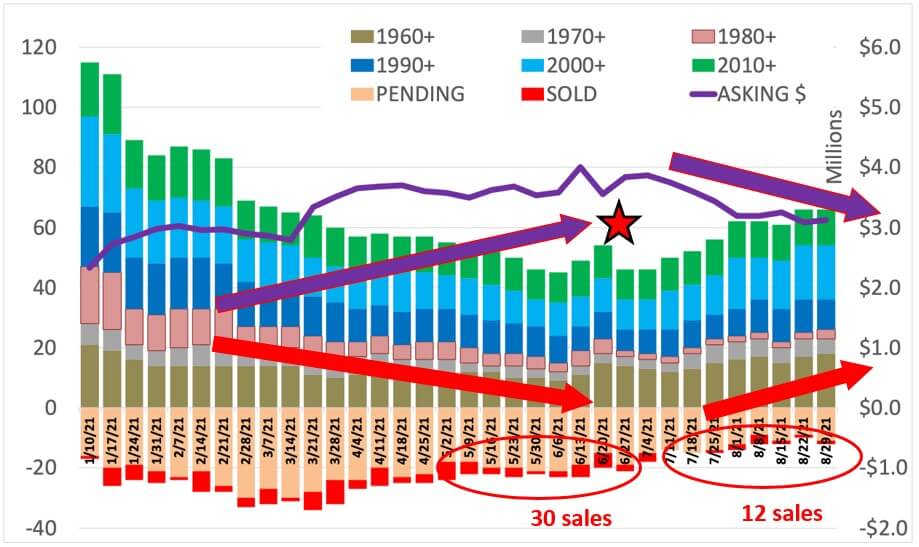

Now let’s see what happened to the prices. Let’s take a look at the average bid price first – this is the purple line. Asking prices rose while inventory declined before the collapse. As we can see, a few weeks after the disaster, asking prices began to decline, and inventory began to pile up. Also, you can see that only 12 trades were completed in 2 months after the accident. Note that 30 deals occurred 2 months before the crash, which is almost three times the volume of sales after the crash.

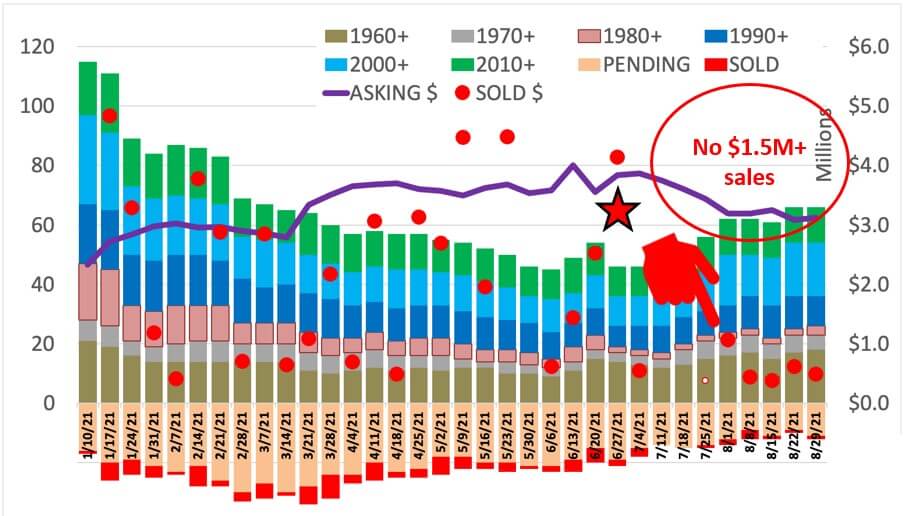

Let’s take a look at the actual sales prices. Red dots represent individual sales. The chart became very busy, but it is clearly seen that after the disaster there were no expensive deals. The most expensive deal was only $ 1.5 million in the last week of July. The drop in sales was expected as buyers are now more cautious about buying oceanfront apartments.

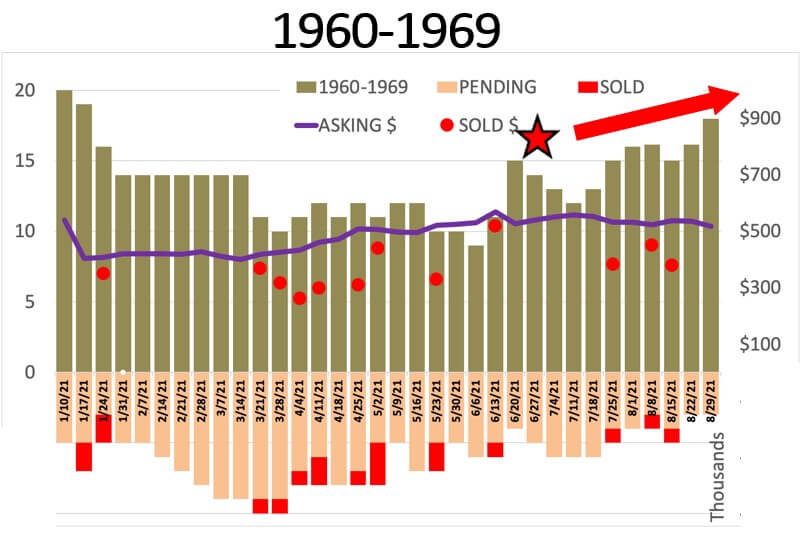

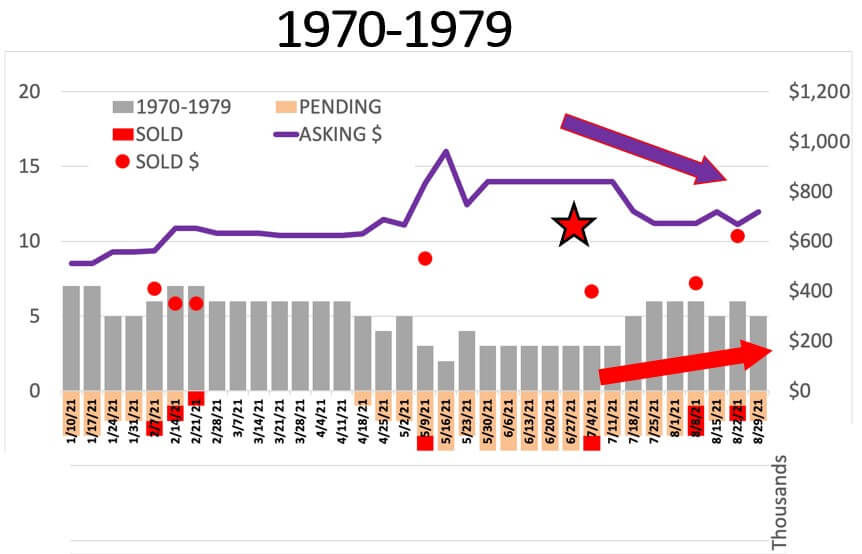

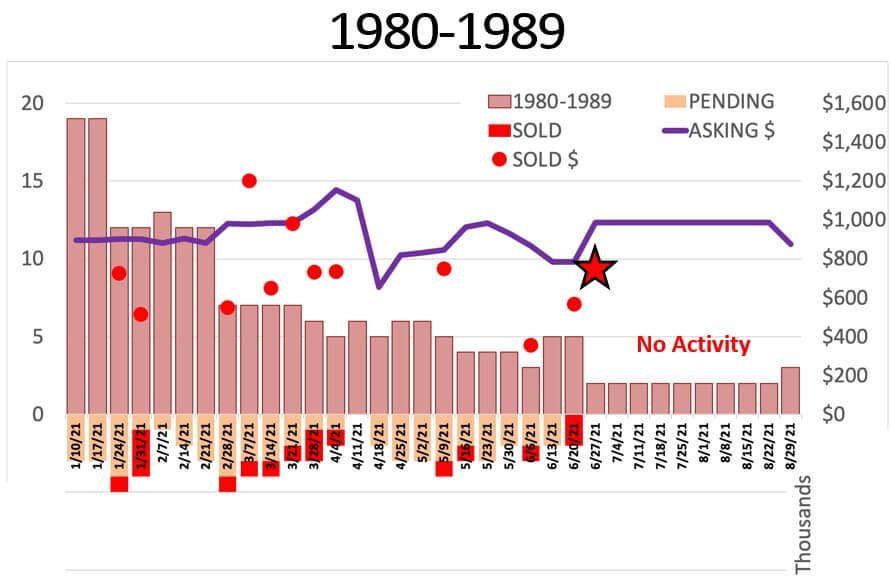

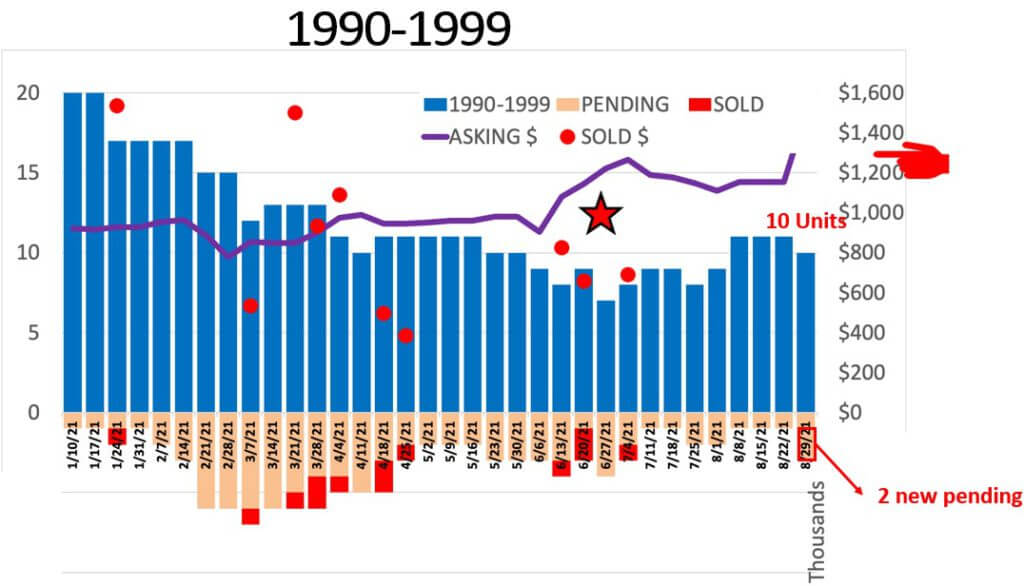

To simplify the picture, let’s look at each segment separately by year.

Let’s start with the buildings of the 60s. Although the inventory continues to grow, we have not seen a decline in selling prices. If we look at the buildings of the 70s, there was no noticeable inventory here back in June. And in July it went up to 5 units. We see a slight drop in asking prices from 840,000 in June to around 700,000 in August.

If we look at the segment of the 80s, it is not surprising that there was no activity here after the crash. Even before the building collapsed in June, inventory in this segment was very low. There are currently only two apartments for sale: a 4-room apartment in the Marbella building is currently on sale for 1,250,000 and a 2-room apartment in Champlain North is worth 750,000.

In the segment of the 90s, there are no significant changes – now there are 10 objects for sale, which is similar to the level before the collapse. The average asking price is just over $ 1.2 million, which is roughly the level before the building collapsed. It should be noted that contracts for 2 apartments were concluded last week, which may indicate some interest of buyers in this segment at the moment.

Now on to buildings built after 2000: there has been a steady increase in both the inventory level and the average asking price. Over the past 2 months, the inventory has almost doubled from 10 apartments at the end of June to 18 at the end of August. The average selling price increased by 100 thousand from 1.2 million to 1.3 million. Two sales took place in the last week of July: one apartment was sold for $ 1.55 million and the other for just $ 592,000. And 1 deal took place last week – a $ 495,000 3-bedroom apartment in the Waverly building.

If we look at the most expensive segment of apartments built over the past 10 years, then there have been no changes in the inventory here – currently 12 apartments are for sale. The average selling price fell about 12 percent from 14.4 million to 12.6 million. This is an insignificant deviation due to the small number of objects. It is worth noting, however, that sales through the MLS have not been recorded in the last 2 months, while there were 3 separate sales made in June: an apartment in Surfclub was sold for $ 3,650,000, an apartment in Chautau was sold for $ 7.3 million. and the residence in Arte was sold for $ 10.2 million.

Let’s summarize. We looked at what happened 2 months after the Surfside tower collapse. In general, there are no significant changes in the real estate sector. The inventory level increased slightly in all segments. It is also worth noting that over the past 2 months there were slightly fewer properties sold, and fewer properties were in the process of completing a transaction.

While we are seeing an overall decline in the average asking price, this is mainly attributable to the segment of buildings built in the last 10 years. In all other segments, the average selling price increased. Of course, buildings built in the 80s suffered the most, as there were no completed transactions in this segment in the last 2 months.